Plan Design > Rules Library > Indirect Credit

Indirect credits enable you to calculate a credit amount to other positions in the company

based on direct credits and relationships. Indirect credits are not created if the

direct credit is:

• Held

• Not “rollable”

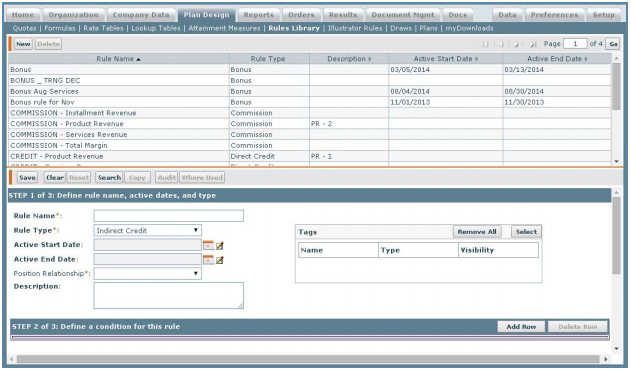

Screen

Indirect Credit Rule Screen

All Fields

The following table describes the information you can specify when managing indirect

credit rules:

| Section | Field | Description |

|---|---|---|

| Step 1 | Rule Name | The Name of the rule. The maximum length is 64 characters. |

| Rule Type | The type of rule, in this case Indirect credit. | |

| Active Start Date | The active start date for the rule. | |

| Active End Date | The active ends date | |

| Position Relationship | The relationship of the position. | |

| Description | A description of the rule. | |

| Tags | The tags associated with the rule (as defined in the Setup > Tags area). | |

| Step 2 | Add Row | Add a condition for a rule. |

| Step 3 | Result Name | The name of the result. |

| Value | The formula or value used to determine the value of the indirect credit. | |

| Value UnitType | The value UnitType in which the indirect credit result is calculated. |

|

| Maximum | The maximum threshold value across all indirect credits given for a particular Order Item. |

|

| Credit Type | The type of credit to apply, such as revenue and maintenance. |

|

| Hold Period | The unit (days, months, quarters, years), date, or date formula specified in the Hold field. |

|

| Hold | How long the indirect credit should be held from the incentive date before being released. |

|

| Reason Code | Used to track different types of credits such as bonuses and commissions. The value can be one of the following: • Advance • Manual Bonus • Manual Override • Split Correction |

How to…

This section describes how to manage indirect credit rules.

Search Indirect Credit Rules

1. Click the Plan Design tab, then click Rules Library in the secondary menu. The

Rules Library screen appears.

2. (Optional) Specify the search criteria in the corresponding fields.

3. (Optional) In the Tags field, click the Select button. The Select General Tags dialog

appears.

Select the tags to use in the search and click the Apply Selected Tags to Rule button.

4. Click the Search button. The matching rules appear in the results area.

Create an Indirect Credit Rule

An Indirect Credit Rule is used when a credit needs to be given to users who are connected

to the owner of an order through a relationship (related order, reporting, or

user defined relationship type).

1. Click the Plan Design tab, then click Rules Library in the secondary menu. The

Rules Library screen appears.

2. Click the New button.

Step 1: Define rule name, active dates, and type

3. Enter a rule name being created in the Rule Name*.

4. Select Indirect Credit from the Rule Type* drop-down list. This is the rule type that is

being created.

5. (Optional) Enter or select the Active Start Date of the rule by doing one of the following:

• Click the calendar icon and then click the OK button.

• Click the calendar icon and double-click a date.

6. (Optional) Enter or select the Active End Date of the rule by doing one of the following:

• Click the calendar icon and then click the OK button.

• Click the calendar icon and double-click a date.

note: This rule is valid only when the Order Item Incentive Date falls within the

Active Start Date and Active End Date. If the dates are not filled in, the rule will be

active for an indefinite period.

7. Select a Position Relationship* from the drop-down list. This is the relationship type

used to give indirect credit. The Position Relationship options include the following,

in addition to user-defined relationship types:

• Reporting—The relationship between the direct and indirect person is defined

by the hierarchy.

• Related Order (Person)—The relationship is defined by the indirect people

associated with the related order item.

• Related Order (Position)—The relationship is defined by the person in the specified

position. The indirect credit goes to the person associated with the position.

For example, when Sam with an Indirect Credit (Reporting) is moved out

of a position, Pete is moved into the position. Pete has an Indirect Credit

(Related Order Position) rule, which ties him to the position.

• Any user-defined relationships.

note: The relationship that should trigger this rule needs to be selected. The Position

Relationship field appears when you select Indirect Credit from the Rule Type

drop-down list.

8. (Optional) Enter a description of the rule being created in the Description field.

9. (Optional) In the Tags field, add or remove the tags associated with the rule.

Do the following:

• To add or remove tags, click the Select button. The Select Rules Tags dialog

appears.

Select the tags you want to associate with the rule and click the Apply

Selected Tags to Rule button. You can also find specific tags (using the Find

Tags search box), and create new tags, as required.

note: You can associate up to 50 tags with a rule.

For more information about managing tags, see “Tags”

• To remove all tags associated with the rule, click the Remove All button. Exercise

caution when removing all associated tags because this action does not

ask for confirmation.

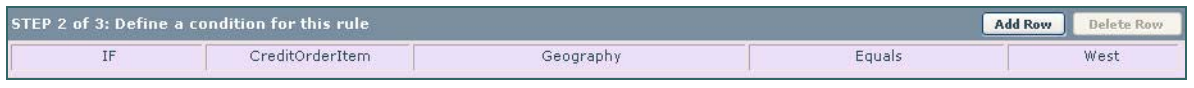

Step 2: Define a condition for this rule

The result of a condition determines whether or not the rule can be computed for a

given order.

note: It is not necessary to define a condition for any rules.

10. Scroll down and define a condition for the rule by clicking the Add Row button.

note: “IF” automatically appears in the first column and cannot be changed. If

you add more rows, the choices will change to AND & OR.

11. (Optional) Select a condition from each column’s drop-down list.

note: Depending on what condition you choose from the second column’s dropdown

list, the next column’s drop-down list changes to choices that pertain to the

first condition selected.

For this example, the following selections were chosen:

Defined Conditions – Indirect Credit

note: The following function should be used in Indirect Credit rules ONLY: CreditOrderItem.TotalAmount.

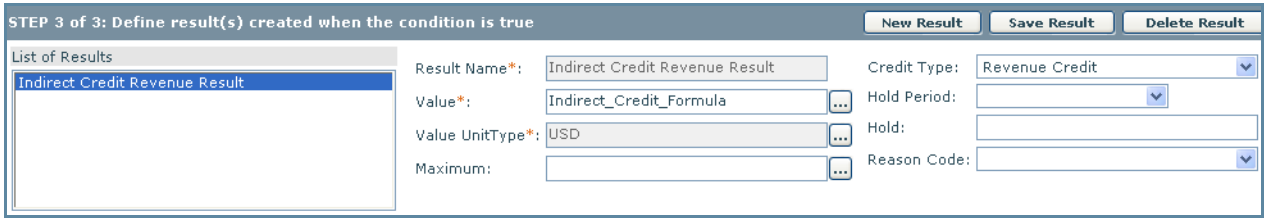

Step 3: Define result(s) created when the condition is true

12. Enter a result name in the Result Name* field. The name of the result that will be

created.

13. Enter a value or click the ![]() button next to the Value* field. This is the formula or

button next to the Value* field. This is the formula or

value that is used to determine the value of the direct credit.

note: If you click the button next to the Value field, the Select a Formula screen

appears. Select a Formula and click the OK button. The formula appears in the

Value field.

For example, the following formula is one you might use in an indirect credit rule:

If the indirect credit is equal to the credit amount given to the person on the order

item, select the following: Credit.Amount.

14. Select a Value UnitType* from the drop-down list. This is the value UnitType in which

the indirect credit result will be calculated.

15. (Optional) Enter a value or click the ![]() button next to the Maximum field. This is

button next to the Maximum field. This is

the maximum threshold value across all indirect credits given for a particular Order

Item.

If you click the button next to the Maximum field, the Select a Formula screen

appears. Select a Formula and click the OK button. The formula appears in the

Maximum field.

note: When defining a formula for the maximum threshold, have the formula refer

to a field on the Order Item (such as CreditOrderItem.TotalAmount) and not to a

value on the direct credit (such as Credit.Amount) since the direct credit value

may vary based on the credit being calculated.

16. (Optional) Select a Credit Type from the drop-down list. This is the type of credit

that will be applied, such as revenue or booking.

17. (Optional) Choose a Hold Period from the drop-down list. The hold period represents

the unit (days, months, quarters, years), date, or date formula specified in

the Hold field. See Hold Period Use Cases and Example.

18. Enter or choose the Hold value. This specifies how long the indirect credit should

be held before being released. If you chose Days, Months, Quarters, or Years in

the Hold Period field, enter a numeric value. If you chose Date in the Hold Period

field, do one of the following:

• Click the calendar icon and then click the OK button.

• Click the calendar icon and double-click a date.

• Click the , button, select a date formula, and click OK.

note: If the Hold Day(s) field is zero or empty, the indirect credit will be calculated

based on the incentive date of the order. See Hold Period Use Cases and Example.

note: Incent does not support the release of a held credit into a year that is different

than the year of the Incentive Date on the Order Item.

19. (Optional) Select a Reason Code from the drop-down list. Reason codes are used

to track different types of payments such as bonus or commission. This list is

defined in Setup > Configure > Reason Code.

note: The choices that appear under Unit Type, Credit Type, and Reason Code

can be deleted, changed, or new choices can be added.

20. Click the Save Result button. The newly created result appears in the List of Results

section to the left.

Defined Indirect Credit Results

note: If you want to create more than one result, click the Save Result button, then

click the New Result button, and repeat Step 3: Define result(s) created when the

condition is true

21. Click the Save button. The newly created Indirect Credit now appears, highlighted,

in the Results Pane area.

Newly Created Indirect Credit Rule

Edit an Indirect Credit Rule

You can edit an indirect credit rule and save the new definition using the existing rule

name.

Modifying Step 1: Define rule name, active dates, and type

1. Select an Indirect Credit rule from the Results Pane. The selected rule is highlighted.

2. Select and edit the fields that require changes.

3. Click the Save button.

Modifying Step 2: Define a condition for this rule

1. Select an Indirect Credit rule from the Results Pane. The selected rule is highlighted.

2. Scroll to the Step 2 condition area.

3. Select and edit the fields that require changes.

4. Click the Save button.

Modifying Step 3: Define result(s) created when the condition is true

note: The Result Name cannot be modified. The only way to modify this field is to

delete and recreate the result.

1. Select an Indirect Credit rule from the Results Pane. The selected rule is highlighted.

2. Scroll to the Step 3 results area.

3. Click a result in the List of Results. The selected result is highlighted and appears in

the Result Name field.

4. Select and edit the fields that require changes.

5. Click the Save Result or Save button.

Delete an Indirect Credit Rule

1. Click an Indirect Credit rule. The selected rule is highlighted. If there are results

computed for this rule, the rule cannot be deleted.

2. Click the Delete button. A message appears asking “Do you really want to delete

the selected item?”.

3. Click the OK button to confirm the deletion, or click the Cancel button to cancel

the action.

Delete a Condition

1. Select an Indirect Credit Rule from the Results Pane. The selected rule is highlighted.

2. Scroll to the Step 2 condition area.

3. Click a condition.

4. Click the Delete Row button. A message appears asking “Do you really want to

delete the selected item?”.

5. Click the OK button to confirm the deletion, or click the Cancel button to cancel

the action.

6. Click the Save button.

Delete a Result

note: At least one result needs to be in the rule for the rule to exist.

1. Select an Indirect Credit Rule from the Results Pane. The selected rule is highlighted.

2. Scroll to the Step 3 results area.

3. Click a result in the List of Results. The result is highlighted and appears in the Result

Name field.

4. Click the Delete Result button. A message appears asking “Do you really want to

delete the selected item?”.

5. Click the OK button to confirm the deletion, or click the Cancel button to cancel

the action.

6. Click the Save button.

Create a New Indirect Credit Rule by Copying an Existing Rule

1. Select an Indirect Credit rule from the Results Pane. The selected rule is highlighted.

2. Click the Copy button.

3. Type a new name in the Rule Name* field.

4. Change the settings (including the conditions and results) for the rule, as required.

For more information about modifying conditions and results, see “Edit an Indirect

Credit Rule”

5. Click the Save button. The newly created rule appears in the Results Pane.

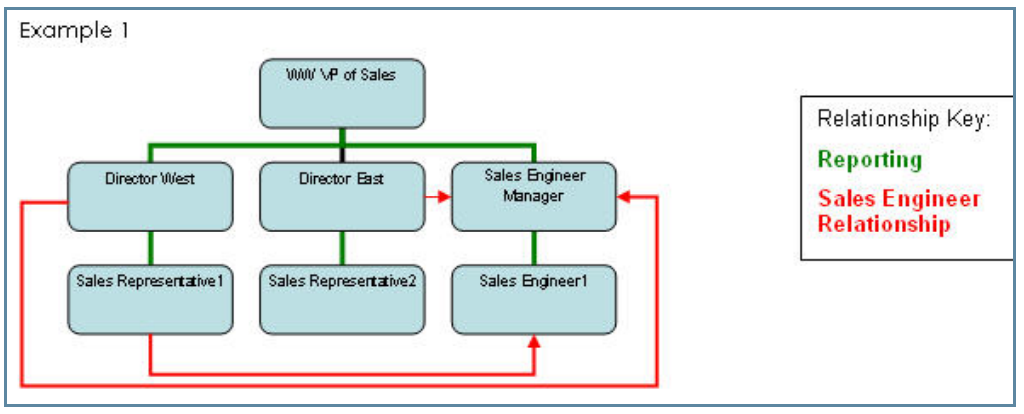

Examples of Direct Credits Rolling to Create Indirect Credits

Direct credits can roll to create indirect credits based on the reporting relationship or

user-defined relationship types.

Indirect to Indirect Credit Rolling

Example 1: Assume all positions have a direct/indirect credit rule (Sales Representative

1 has a Direct Credit rule and all others have Indirect Credit rules) and

assume all positions are on a plan.

Direct/Indirect Credit Rule – Example 1

Table 2: Use Case 1 – Direct Credit given to Sales Representative1 in amount $100

| Position | Relationship | Source Credit | Credit |

|---|---|---|---|

| Sales Representative 1 | Direct Credit1 ($100) | ||

| Director West | Reporting | Direct Credit1 | Indirect Credit ($100) |

| WW VP of Sales | Reporting | Direct Credit1 | Indirect Credit2 ($100) |

| Sales Engineer Relationship1 | Sales Engineer Relationship | Direct Credit1 | Indirect Credit3 ($100) |

| Sales Engineer Manager | Sales Engineer Relationship | Direct Credit1 | Indirect Credit4 ($100) |

Table 3: Use Case 2 – Direct Credit given to Sales Representative2 in amount $100

| Position | Relationship | Source Credit | Credit |

|---|---|---|---|

| Sales Representative2 | Direct Credit1 |

||

| Director East | Reporting | Direct Credit1 | Indirect Credit1($100) |

| WW VP of Sales | Reporting | Direct Credit1 | Indirect Credit2($100) |

| Sales Engineer Manager | Sales Engineer Relationship | Direct Credit1 | Indirect Credit3($100) |

note: Use Cases 1 and 2 are examples of Rollable credits.

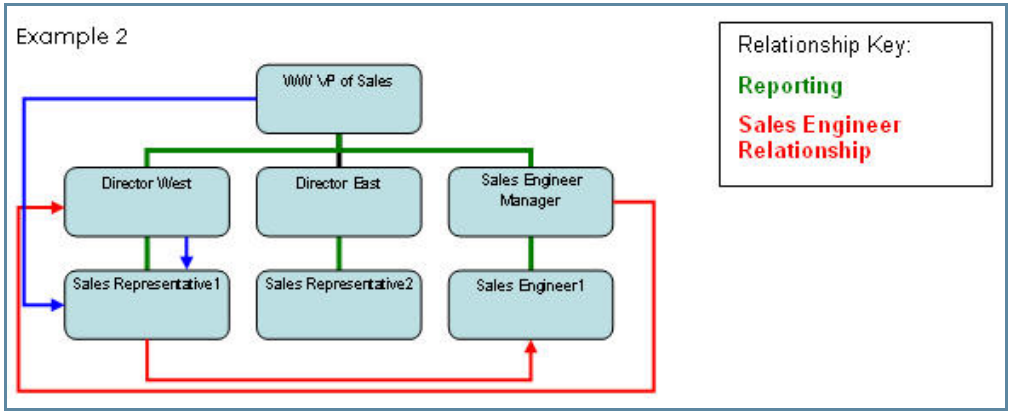

Example 2: Assume all positions have a direct/indirect credit rule

Direct/Indirect Credit Rule – Example2

Table 4: Use Case 3 – Direct Credit given to Sales Representative1 in amount $100

| Position | Relationship | Source Credit | Credit |

|---|---|---|---|

| SR1 | Direct Credit($100) |

||

| Director WW | Reporting | Direct Credit1($100) | Indirect Credit1($100) |

| WW VP of Sales | Reporting | Direct Credit1($100) | Indirect Credit2($100) |

| Sales Engineer1 | Sales Engineer Relationship | Direct Credit1($100) | Indirect Credit3($100) |

| Sales Engineer Manager | Sales Engineer Relationship | Direct Credit1($100) | Indirect Credit4($100) |

| Sales Representative1 | Rolldown | Direct Credit1($100) | Indirect Credit5($100) |

Table 5: Use Case 4 – Direct Credit given to Sales Representative2 in amount $100

| Position | Relationship | Source Credit | Credit |

|---|---|---|---|

| Sales Representative 2 | Direct Credit1($100) |

||

| Director East | Reporting | Direct Credit1($100) | Indirect Credit1($100) |

| WW VP of Sales | Reporting | Direct Credit1($100) | Indirect Credit2($100) |

| Sales Engineer Manager | Sales Engineer Relationship | Direct Credit1($100) | Indirect Credit3($100) |

| Sales Representative1 | Rolldown | Direct Credit1($100) | Indirect Credit4($100) |

note: In Use Case 3, the first four credits are defined as Rollable, and the last two

credits are defined as Rollable On Reporting.